Measuring performance – Fixture List targets

The BHA recently published the 2024 Fixture List, which included wide-ranging innovations designed to deliver a more competitive, engaging and exciting racing product, supporting growth in the number of racing fans and customers with the aim of bolstering the longer-term future of the sport.

The innovations introduced through the 2024 Fixture List are the first phase of the sport’s new long-term industry strategy and were recommended by its cross-industry Commercial Committee and approved by the BHA Board.

All of the changes to the Fixture List have been introduced on a two-year trial basis. HBLB funding for the second year will be determined once a formal evaluation of the first half-year of operation has taken place.

Alongside the publication of the Fixture List, the BHA committed to publishing a series of Key Performance Indicators (KPIs) and measures against which the progress of the trial would be assessed. The BHA and HBLB have agreed, however, that while numerical targets and KPIs are very important, it will not be as simple as coming to a view about success or failure based solely on these targets and that there will be a wide-ranging series of measures, both quantitative and qualitative, through the year.

In this blog BHA Chief Operating Officer, Richard Wayman, sets out those measures and explains the rationale behind them.

It was agreed by everyone involved in the industry strategy that innovation in the fixture list is required with racing currently experiencing a number of negative trends including falling attendances, declining betting on racing, the number of owners under pressure and challenges around race competitiveness.

The proposals focus on using headline events to grow interest in the sport, making more use of Sundays and improving the competitiveness of racing to arrest these declines.

It is important that the effectiveness of these changes can be measured through what will be a two-year trial period, for two main reasons.

Firstly, in order that we can assess and improve the innovations, where possible, over the course of the two-year trial. We intend to take a “test and improve” approach to change through this period.

Secondly, in order that at the end of the trial we can use data to help inform decisions as to which areas of the trial have been successful and should be retained, and which have been less so.

Not all of the changes we have introduced will be immediately successful. Some may take time to bed in – behaviour change frequently does – and some may not work at all. By setting-two-year targets we are, in effect, trying to evaluate a long-term strategy through a very short timeframe.

In addition, the short timeframe means that the targets we have set are not the ultimate, long-term ambitions for where these changes will leave us. In this narrow timescale we are instead looking for early indicators of direction of travel.

It must also be appreciated that there are a number of other significant factors that will impact the sport’s future and the targets set out below over this period, for better or worse. These factors could range from economic factors including the cost of living and possible impact of gambling reforms, through to environmental factors such as the impact of the climate on racing surfaces and fan behaviour.

For this reason, alongside measurement against the targets we set out below, we will also be conducting detailed, retrospective analysis of racing on an ongoing basis. However, it is crucial that any initiative and any strategy is based on measurable data and targets.

This is everyone’s sport and we intend to be as open and transparent as possible around these targets, their measurement and our progress against them.

The business case

The business case set out by the sport was that, over a five-year period, the proposals could improve racing’s finances by approximately £90m in total compared with no fixture list changes being made.

This £90m comprises two areas of growth:

– Changes within the fixture list that encourage increased engagement with existing customers

– Growth and improved retention of new followers of the sport

The projection is that additional revenues build up over the five-year period, with an initial improvement of approximately £6m in 2024.

The basis of these projections is a combination of extensive, reliable data (much of which was provided to us by betting companies on a confidential basis as it is commercially sensitive) alongside some more assumed predictions around consumer behaviour.

The KPIs and targets are measured against historical data and, also, against what would happen if no changes are made to the fixture list and existing trends continue. This dual approach will provide the most accurate view as to whether, and where, the strategy has been successful.

It is also important to note that the changes to the Fixture List are just one part of an extensive, long-term industry strategy. These targets relate to the Fixture List changes alone, however these initiatives are not the only measures that the sport will be taking to bring about change.

For example, benefits to ownership in the sport may be felt significantly more when the initiatives under the Ownership strand of the strategy are delivered, and the success of Premier Racing will be heavily influenced by the strands relating to broadcast engagement and fan experience, work on all of which is well underway.

Measurement process

During the two-year trial, the measurement process will take a dual approach:

1. The setting of targets in advance for 2024 and 2025.

2. Retrospective reporting through the course of 2024 and 2025, involving:

i. Monthly monitoring incorporating analysis of accessible data supported by contextual summaries from the relevant stakeholders.

i. Six-monthly reviews involving more detailed financial analysis against the original business case, as well as qualitative analysis including surveys of customers, investors/owners and the sport’s participants including racing staff.

Reports on this data will be published quarterly by the BHA, and include factors such as betting (while acknowledging that definitive numbers may be commercially sensitive, but directional guidance will be possible), attendances, viewing figures, ownership and race competitiveness.

The Targets

The following targets are a combination of measures of which some are specific to 2024, and some which cover the full two-year period of the trial. Where relevant, the base number will be established at the end of 2023.

The process of compilation of the 2025 Fixture List will begin part way through 2024. Where possible the early indications from data in the trial will be used to inform the process of compiling the 2025 list, as part of our test-and-improve approach.

However, it should be noted that, at such an early stage, the data will be viewed with some caution. Behaviour change takes time, small sample sizes are not always reliable, and so short-term perceived wins and losses should all be viewed in that context.

Betting-Related Targets

- Growing Saturdays by spreading fixtures across the day

– Target 1: Total betting turnover on the 33 Saturdays with only three fixtures in the protected window between 2pm and 4pm to outperform the other 19 Saturdays by 6 to 7%.

– Rationale for Target 1: Analysis of historic betting data illustrates that improving the spread of fixtures across Saturdays will boost total betting activity throughout the day compared with the current more concentrated spread of meetings.

- Opening a new betting session on Sunday evenings

– Target 2: Total betting turnover on Sunday evening fixtures to outperform midweek (Tuesday to Thursday) floodlit fixtures by 15 to 20%

– Rationale for Target 2: Changing behaviours amongst primarily digital betting customers indicates that Sunday evenings will outperform similar fixtures on midweek evenings.

- Slowing the decline in betting on British racing and making more of our headline fixtures

– Target 3: Slowing the decline in betting across the entire fixture list compared with 2023, with Premier Fixtures showing 1-2% better relative performance than the remainder of the fixture list.

– Rationale for Target 3: Measures including the improved spread of fixtures on Saturdays, stronger Sunday fixtures, the introduction of Sunday evenings and more competitive racing across the fixture list are all expected to slow the current decline in betting activity. The focus and investment in Premier Fixtures is expected to result in these fixtures outperforming the rest of the fixture list. An improved relative performance of 1-2% would reflect a significant uplift, given the volume of turnover on Premier racedays compared with the remainder of the fixture list.

Attendance-related targets

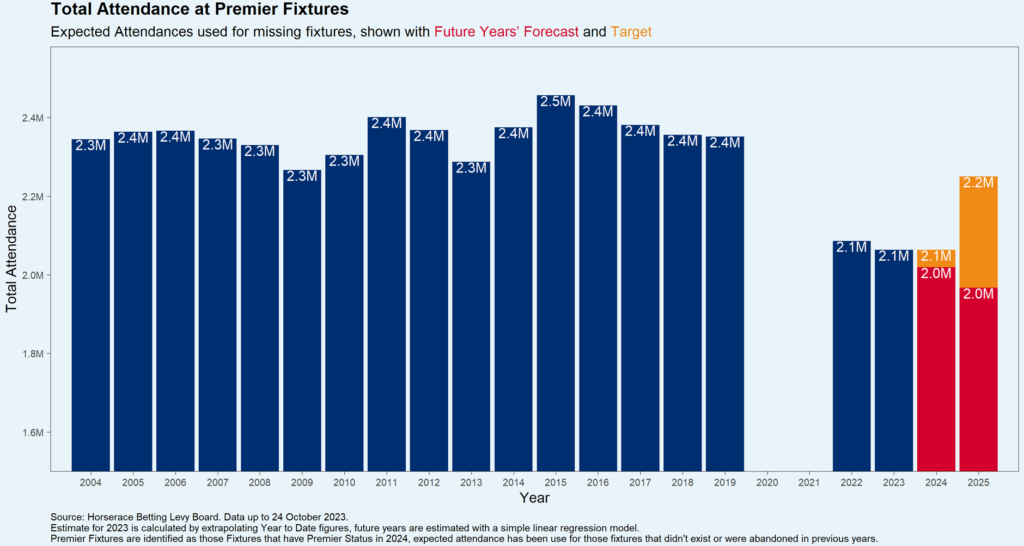

- To grow attendances at Premier Fixtures by 2025

– Target 4: To halt the decline in total attendances at Premier Fixtures in 2024, and then increasing by 5-10% in 2025 versus 2023.

– Rationale for Target 4: The investment in Premier Fixtures aims to use these headline fixtures to increase customers including those attending as racegoers.

The current trend is a declining one (see red boxes in the table below) but, as the quality and competitiveness of many of these meetings improves, the target is for attendances at Premier meetings to hold steady in 2024 before increasing in 2025 to 2.2m to 2.3m, representing a 5-10% rise.

In considering this target, we will assess data around both the picture as a whole, and also excluding the biggest Festivals (e.g. Cheltenham, Aintree, Royal Ascot).

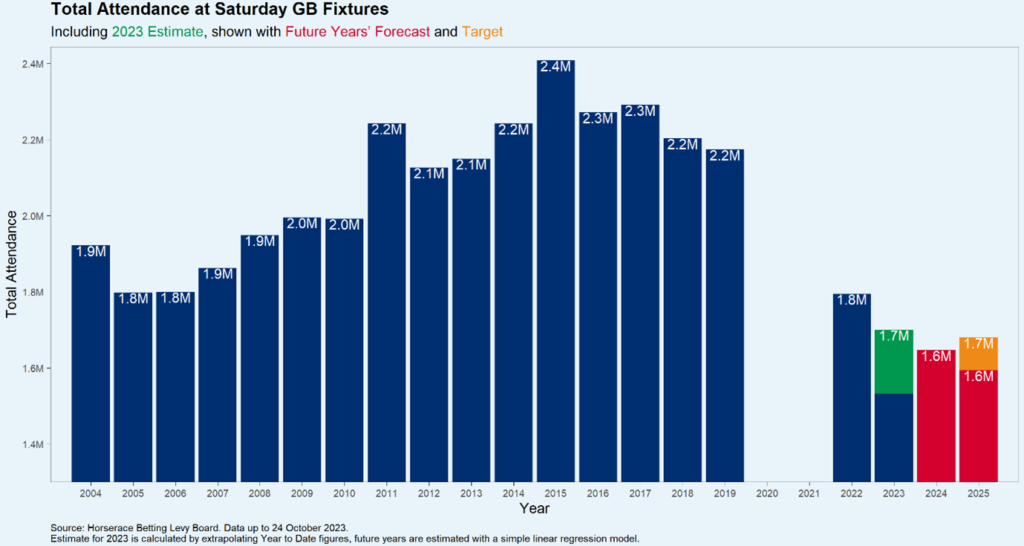

- For Saturday attendances to have largely recovered by 2025

– Target 5: With 41 Saturday fixtures moving from their traditional start times and four fewer fixtures, that Saturday attendances will have recovered to within 25,000 of their current levels by 2025.

– Rationale for Target 5: Saturday attendances are forecast to drop in 2024 as a result of staging four fewer fixtures and changing the start times at 41 fixtures. As customers become used to the new start times and there is growth in attendances at Premier Fixtures, the aim is for total Saturday attendances to have largely recovered by 2025.

Viewer-related targets

- To improve the experience for some viewers by reducing the number of clashing races on Saturday afternoons in 2024.

– Target 6: Recognising the impact on those streaming, watching the racing channels or for customers in betting shops, the target is to reduce the number of clashing races (more than one race taking place in Britain at the same time) on Saturday afternoons in 2024 from nearly 10% to 3%.

– Rationale for Target 6: The intention is to deliver no avoidable direct race clashes between British races on those Saturday afternoons with three fixtures in the protected window. This will support the overall target reduction to only 3% of all Saturday afternoon British races clashing across the year, compared to the 2021-23 three-year average of 9.7%.

Ownership-related targets

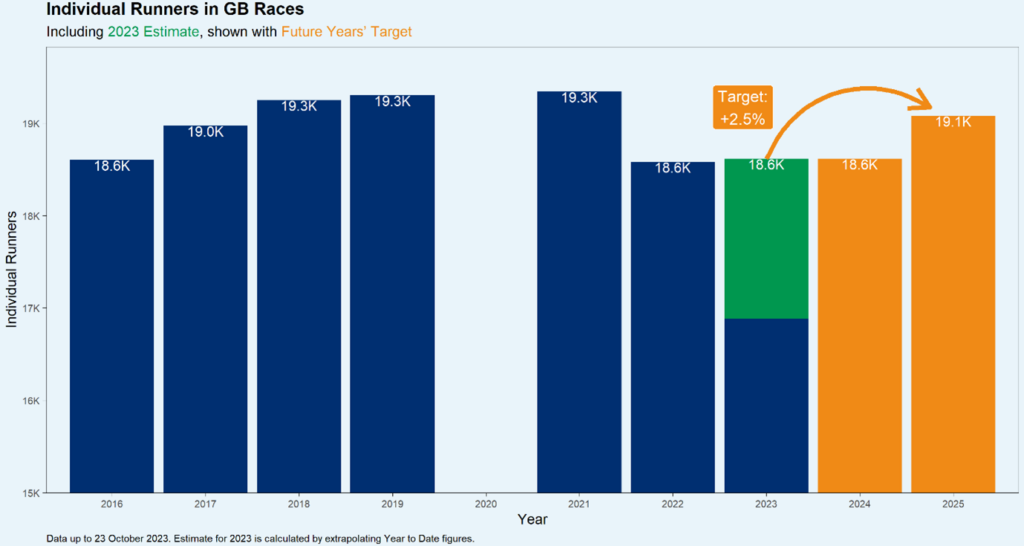

- To increase the total number of horses that appear on a racecourse during the year

– Target 7: To increase the number of horses that race in Britain by 2.5% by 2025 compared with 2023.

– Rationale for Target 7: Additional prize money in Premier Fixtures is intended to support Britain’s international competitiveness and provide a more aspirational structure that encourages the purchase and retention of horses in training in Britain. It is acknowledged that decisions to relating to horse ownership have a lead-in time and therefore this target has been set for 2025.

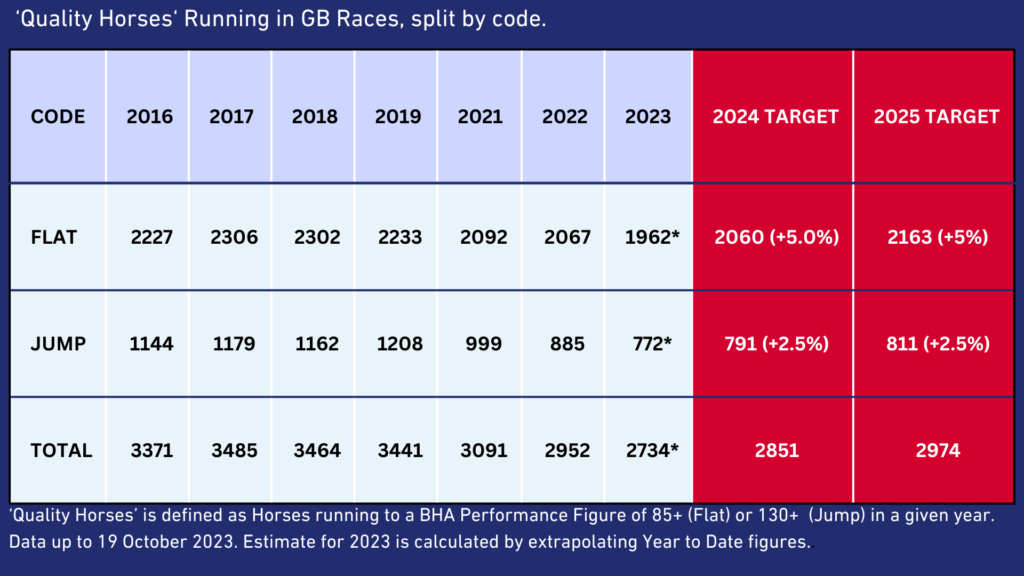

- To grow the number of higher rated horses running in Britain in 2024 and 2025

– Target 8: To increase the number of horses rated 85+ on Flat and 130+ over Jumps. On the Flat, to increase by 5% in 2024 and a further 5% in 2025. Over Jumps, to increase by 2.5% in 2024 and a further 2.5% in 2025.

– Rationale for Target 8: The increased investment in Premier Racing will support the international competitiveness of the upper tiers of British racing. This is designed to encourage owners to retain their better horses in the UK rather than exporting to overseas, which will be measured as part of the retrospective reporting. The larger target for Flat horses recognises the greater element of international competition as well as that changes to the Jump horse population generally take longer.

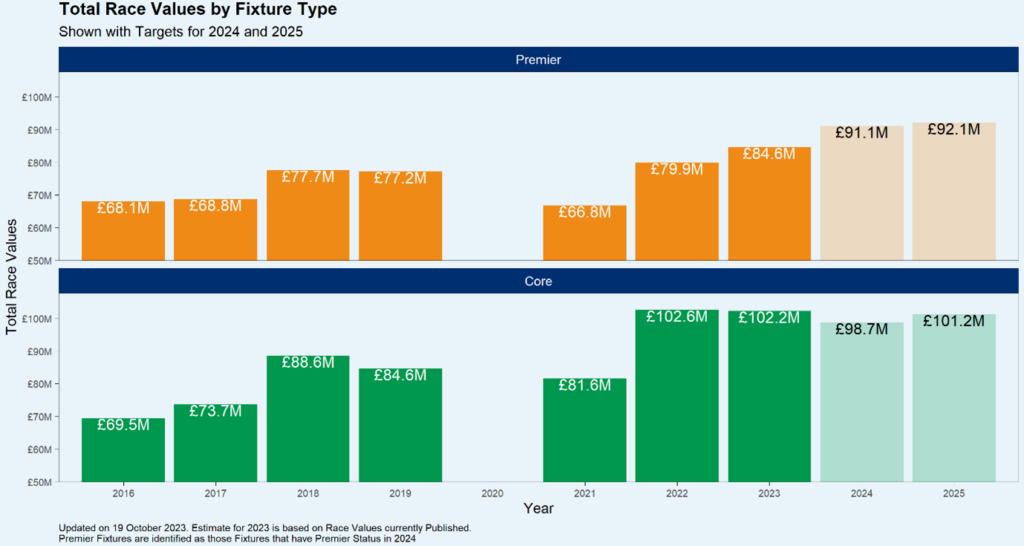

- To grow prize money over the next two years

– Target 9: Total prize money at Premier Fixtures to increase by £6-7m in 2024 and for total prize money at the remainder of the fixture list to return to close to their current levels by 2025.

– Rationale for Target 9: With an additional £3.8m in HBLB funding aimed towards Premier Fixtures, when combined with additional racecourse investment, it is forecast that prize money at these meetings will increase by £6-7m in 2024 compared with 2023. The remainder of the fixture list is expected to decline between £3-4m in 2024, as a result of £1.9m of reduced funding, as well as staging 300 fewer Jump races. As additional revenues are generated in 2024, it is the intention that Core fixtures will benefit from some additional investment in 2025, with prize money levels partially recovering in 2025.

The realisation of this target will be significantly impacted by macroeconomic factors, as well as the impact of affordability checks or other findings from the Gambling Commission’s review of gambling. These factors will be considered when assessing this target.

Competitiveness-related targets

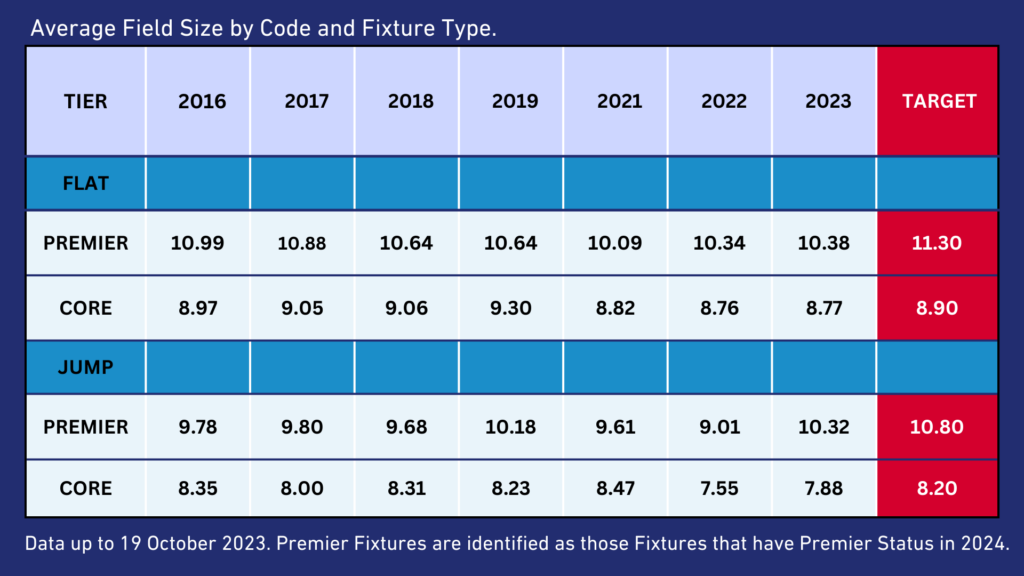

- To grow average field sizes across the fixture list in 2024

– Target 10: To grow average field sizes at Premier and Core fixtures in 2024, both Flat and Jump, compared with 2023

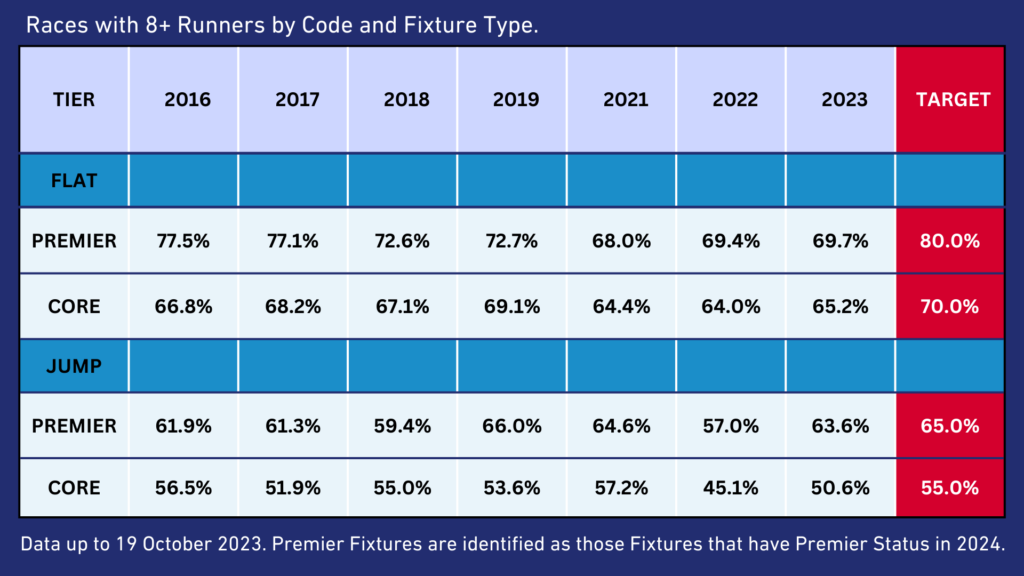

- To increase the proportion of races that achieve 8 or more runners in 2024

– Target 11: To grow the percentage of races with 8+ runners at Premier and Core fixtures in 2024, both Flat and Jump, compared with 2023

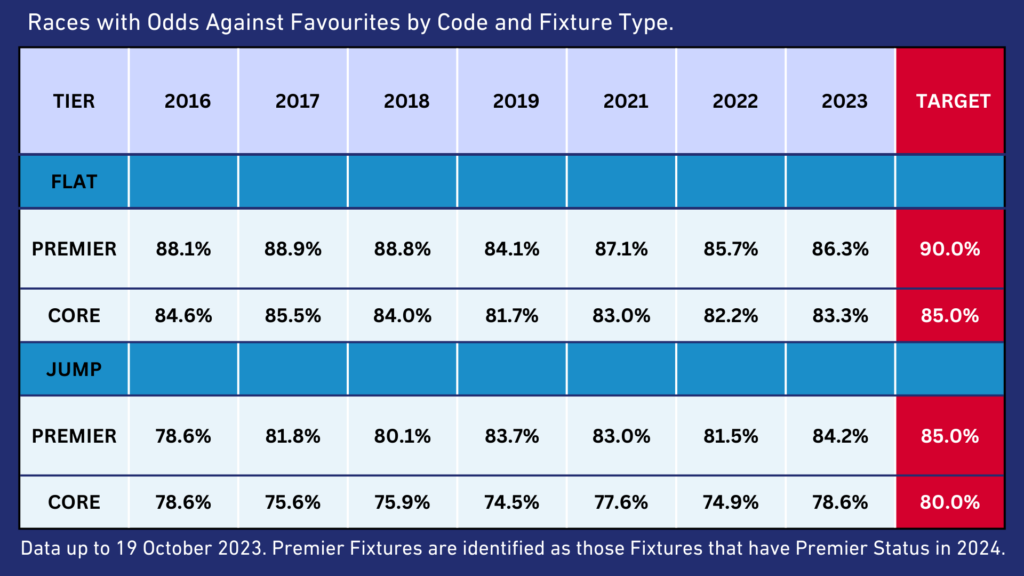

- To increase the percentage of races with odds-against favourites in 2024

– Target 12: To grow the percentage of races with an odds-against favourite at Premier and Core fixtures in 2024, both Flat and Jump, compared with 2023

– Rationale for Targets 10, 11 and 12: A raft of measures will be introduced in 2024 to support race competitiveness including 300 fewer Jump races, moving 200 Flat races out of the summer into the autumn, more agile race planning/programming 100 races much closer to raceday, cancelling low grade handicaps with three or fewer runners, transferring fixtures onto the all-weather during periods of extreme weather and ground conditions and so on.The volume changes have been driven by achieving target field sizes, with higher targets set for Premier Fixtures compared with the rest of the fixture list. That said, combined with changes to the race programme, increased competitiveness is targeted across all fixtures in 2024.

In Conclusion

It is extremely important that the changes to the Fixture List as part of this trial are measured. This will help us to hone the proposals over the course of the trial, and ultimately provide us with evidence regarding the success, or otherwise, of the various changes.

The sport has made significant changes to the fixture list in 2024, with the scale of change far exceeding anything agreed in recent times. The targets we have set are challenging in a short timeframe, but we are optimistic they can be achieved. If they are then this will represent an extremely positive start for our sport’s long-term plans for growth.

In the interests of transparency we have adopted a dual approach of setting targets in advance alongside retrospective, public reporting.

We are not aware of any other sport which has set out KPIs as detailed as this in public. We hope this demonstrates our commitment to transparency and openness around the industry strategy.

Each target will have a different impact on the overall success or otherwise of the strategy, with many of the targets being inter-related. Therefore no measure is likely to be assessed in absolute isolation as a “pass or fail”.

The data will not be the only factor we consider when making decisions. We will be speaking to our audiences and participants throughout this process and will factor in their perspectives alongside the evaluation when determining next steps. This will include qualitative research in relation to areas such as workforce wellbeing and insights into how engaging the sport’s customers are finding the changes we have made.

However, it is essential that we track our progress, and through ongoing evaluation and measurement we can make better informed decisions about what to take forward and what to let go.

The sport has faced a difficult couple of years, and if we had not taken any steps to intervene then I would be concerned about the direction in which our industry was heading. However, as a result of the collaboration that is taking place across the industry, and the agreed approach to our strategy and the need for change, I am more optimistic than ever that we can secure the fine future which our great sport warrants.