Racing’s Cancelled Day – the sport unites

By Greg Swift, BHA Director of Communications and Corporate Affairs:

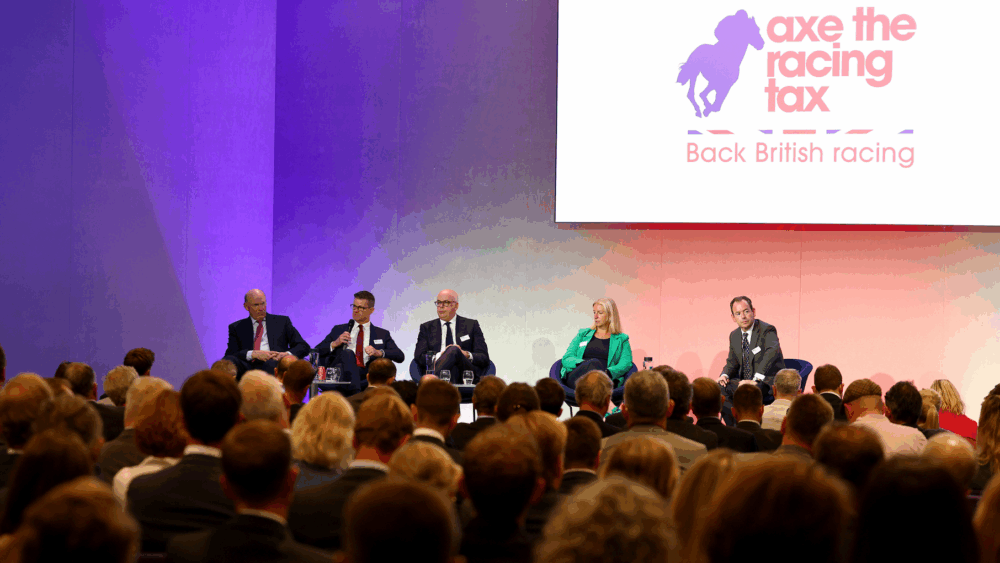

British Racing’s Axe The Racing Tax campaign ramped up a gear on Wednesday 10th September with ‘Racing’s Cancelled Day’, when the sport refused to race for the first time in its history.

Racing’s senior leaders were joined by owners, trainers and jockeys at a major campaign event in Westminster to highlight to politicians and media the devastating impact that HM Treasury’s proposals to harmonise remote gambling taxes would have on the nation’s second-largest spectator sport – and the communities and livelihoods that depend on it.

It was an unprecedented step to take. But it was a step that powerfully articulated the industry’s strength of feeling against a proposal the Treasury claims will simplify online betting taxes, but which will in reality only make horseracing significantly less profitable for bookmakers in comparison to other betting products. The consequences of this ‘racing tax’ on operators will have a severe knock-on impact on our sport which has a uniquely symbiotic relationship with the betting industry.

Racing’s leaders are united in conveying a simple message to the Government: ensure that this symbiotic relationship, the 85,000 livelihoods which depend on the sport, and racing’s immense contribution to Britain’s culture and economy, is recognised by taxing British horseracing at a different, lower rate to other betting products.

We have been consistently clear that it is not our place to opine on how other betting products are taxed or at what rate. Indeed, the Treasury has been clear throughout that it is only seeking views on the principle of harmonisation, not potential rates. It is on that basis alone that we have engaged with the Government.

However, it is inevitable that any proposal relating to how taxes are organised will invite discussion and speculation around tax rates themselves.

With the Government facing difficult economic headwinds, it would be naïve to assume that harmonisation would result in taxes going down. This is why the Axe The Racing Tax campaign has argued that it is most likely that taxes on horseracing would only increase to at least the current 21% that operators pay on online gaming. Given the size of the fiscal black hole facing the Government it is reasonable to assume that the rate may be considerably higher.

And with gambling policy being an area of focus for the influential gambling reform lobby – and a significant number of MPs on the Government benches – it is also inevitable that wider views on gambling regulation and taxation more broadly will be aired.

Over the summer, the views of the independent think tank the Social Market Foundation, former Prime Minister Gordon Brown and the All-Party Parliamentary Group on Gambling Reform have attracted debate, with all proposing radical changes in gambling taxation, particularly in relation to online gaming.

It is important against that noisy backdrop to be crystal clear about one thing. Our Axe The Racing Tax campaign has only one focus: to protect the sport of horseracing by calling for the sport to be taxed at a different, lower rate.

This is why suggestions the sport is working closely with the anti-gambling lobby are simply inaccurate. The BHA – along with other racing stakeholders – attended one roundtable organised by the SMF in the spring which explored racing’s views on the Treasury proposals.

With the SMF being an independent think tank well-respected by those in government, it would be remiss of any industry to refuse to share its own insights with an organisation that regularly makes recommendations to those in power, even if there is not support from said industry for every recommendation made.

As our CEO, Brant Dunshea (pictured above) recently told the Racing Post: “History has shown that engagement and transparency with critics is central to an industry maintaining its social licence. Any modern and progressive industry must be able to engage with those that have opposing views, and it is logical to engage various bodies when making our case heard, including respected think tanks and third-party advocates.

However, this does not equate to racing forming a closer relationship with any such bodies, and this is especially the case as regards the anti-gambling lobby.”

This same message was relayed by Brant at Racing’s Cancelled Day Westminster event, where delegates also heard from Assistant Trainer to John O’Shea – and former Thoroughbred Industry Employee of the Year – Sarah Guest. Sarah is a passionate champion of racing who in conversation with Nick Luck brought to life what the sport means to stable staff in communities across the country.

Her emotive words were accompanied by two short films: Thanks to the Thoroughbred (below), which tells the story of how many livelihoods depend on one horse in training – with Paisley Park the star of the show – and an Axe The Racing Tax campaign film (above), showcasing what racing means to participants, racegoers and small business owners.

There may have been some who attended the event who were sceptical about whether the Axe The Racing Tax campaign was compelling or cutting through to politicians and the public. Yet Racing’s Cancelled Day attracted a huge amount of media coverage in the 48 hours before and after the event itself, receiving over 530 pieces of coverage across broadcast and print media including 179 national broadcast segments and 73 national print and online articles.

This included extensive coverage on BBC Breakfast, Good Morning Britain, ITV News and prominent features in The Times, The Telegraph, The Sun, Daily Mirror, Daily Express, The Independent – and a Daily Star front page.

Added to more than 200 people attending the event in Westminster, 20 senior politicians attending in what was a busy day in Parliament as urgent questions were tabled on major international issues, and the #AxeTheRacingTax hashtag seen more than 3 million times on social media, it is clear the campaign is having an impact.

This cut-through is best represented by the fact that the Exchequer Secretary to the Treasury issued a proactive statement to political journalists on Racing’s Cancelled Day. This is a rare step for the Treasury to take.

The unprecedented coverage, reaction and support that the campaign has received so far shows that Axe The Racing Tax really is cutting through. And it is a fight we will continue to take to the Treasury ahead of November’s Budget.